Are you considering investing in crypto collectibles or NFTs? More and more people are interested in this new form of digital ownership. If you’re new to the world of NFT trading, consider reading my article “How NFTs are Revolutionizing the Digital World.” It’s a good introduction to NFTs.

If you are coming to this page looking for a guide on how to choose an NFT marketplace, you have come to the right place. There are many options to choose from, namely, OpenSea, Blur, LooksRare, Rarible, and many others. With so many options, it can be challenging to know which platform to use to buy, sell and mint digital assets or NFTs.

In this article, we will provide a comprehensive comparison between two leading NFT marketplaces: Opensea and the Blur NFT marketplace. Our analysis will cover the history, features, user experience, advantages, and disadvantages of each platform. We will also explore the key differences between Opensea and Blur, including their aggregator capabilities, bidding features, and fee structures. Finally, we will discuss the battle that is taking place between OpenSea and Blur over customer loyalty, and we will provide our verdict on which platform is better for discovering, buying, and selling NFTs, as well as which is better for NFT creators. By the end of this article, you will have a better understanding of the world of NFT trading and the differences between two of the leading marketplaces.

OpenSea History

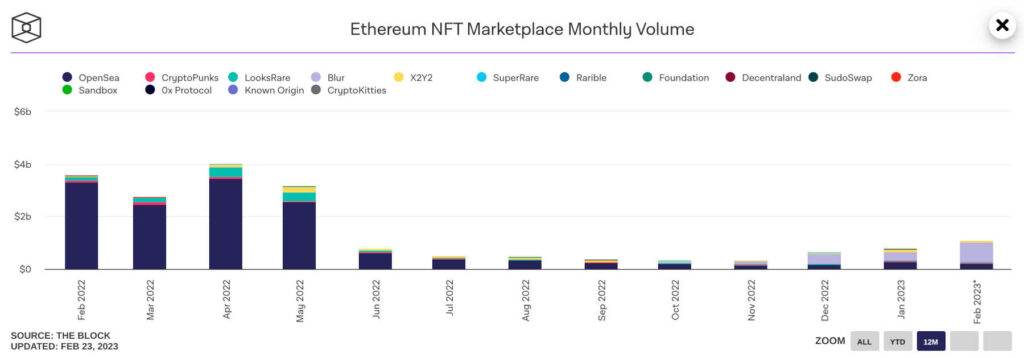

Opensea is a marketplace founded in 2017 that specializes in trading non-fungible tokens. Following a surge of interest in NFTs, Opensea’s revenue experienced a massive increase in 2021, reaching $95 million in February and $2.75 billion in September. By January 2022, Opensea had been valued at $13.3 billion and was the largest non-fungible token marketplace. On May 1, 2022, OpenSea set a record for daily trading volume, reaching $2.7 billion. However, by September of that year, the daily trading volume had dropped by 99%.

OpenSea Features

OpenSea is a non-fungible token marketplace powered by smart contract technology that allows users to securely trade their assets without needing to create an account. Transactions take place directly between wallets, such as MetaMask, and no personal information is required. OpenSea acts as an intermediary for the trades and does not require custody of the assets.

OpenSea Advantages

OpenSea provides users with a secure and convenient platform to trade their assets–they even have a mobile app. Until mid-February of 2023, the platform charged a 2.5% fee on all sales and up to a 10% royalty, which goes to the original NFT creator. Additionally, users can easily create their own NFTs using OpenSea’s minting tool, which is free of charge. In 2021, OpenSea launched a zero gas fee program, which allows creators to mint NFTs without any upfront costs. This feature also has the benefit of the NFT living off-chain until the NFT is purchased. The NFT is transferred on-chain after the purchase is made or if a listing is canceled.

OpenSea Disadvantages

OpenSea does not currently support payments in fiat currencies such as USD or AUD, and users must transact using cryptocurrency. This can be seen as a disadvantage, as it excludes those without access to cryptocurrency or knowledge of how to use it. It is also a centralized exchange, meaning that it is not always as secure as a decentralized platform. This was demonstrated when a bug in the OpenSea NFT marketplace allowed hackers to steal rare NFTs for much less than the market value and resell them for large profits, pocketing over $1 million. Moreover, OpenSea has faced exploitation by its management in the past, when a high-ranking employee was accused of insider trading. This has caused many to question the platform’s security and trustworthiness. The team has promised to take a stand against team members using confidential information for NFT purchases, but the incident has raised concerns. Despite the potential drawbacks, OpenSea remains a convenient and intuitive platform for users to securely trade their assets.

On November 8, 2022, OpenSea introduced an “Operator Filter Registry” that gave creators of new NFT collections a choice. They could use the tool, which would block their tokens from being traded on marketplaces that didn’t enforce royalties, or else OpenSea wouldn’t enforce royalties for the collection on its own marketplace. Since most NFT trading happens on OpenSea, it’s a difficult decision for creators. However, using the tool means losing out on additional exposure on marketplaces like LooksRare, SudoSwap, and Blur.

Blur NFT Marketplace History

Blur was started in May of 2022 by invitation only, but from day one, they rewarded their users with “Blur Points.” On October 19, 2022, Blur launched its NFT marketplace. To celebrate their launch, they promised to airdrop Care Packages containing $BLUR tokens to anyone who had been trading NFTs on the Ethereum Blockchain. Additionally, they promised a second Care Package airdrop for all traders who listed NFTs on Blur. Finally, they planned an “Airdrop 3” for traders who place bids on Blur. On February 14, 2023, about 360 million $BLUR tokens were airdropped to the Blur community for Airdrops 1, 2, and 3. Between October 19, 2022, and mid-February of 2023, 146,823 users traded on Blur with $1.2 billion dollars worth of NFT trades (wash trading excluded).

NFT Marketplace Blur Advantages

Blur is designed for pro traders, and Blur is one of the fastest-growing NFT marketplaces. Blur offers two services. First, Blur is an aggregator, which means that Blur searches all of the NFT marketplaces on the Ethereum blockchain for the searched NFT with the best price. Once found, the user can execute the purchase on Blur. Second, Blur offers an auction for NFTs, and bids and trades are free of gas fees. The user deposits ETH into the bidding platform, and all bids, buy, and sell orders are executed without gas fees. Only when a user withdraws an NFT does a user pay Ethereum blockchain gas fees.

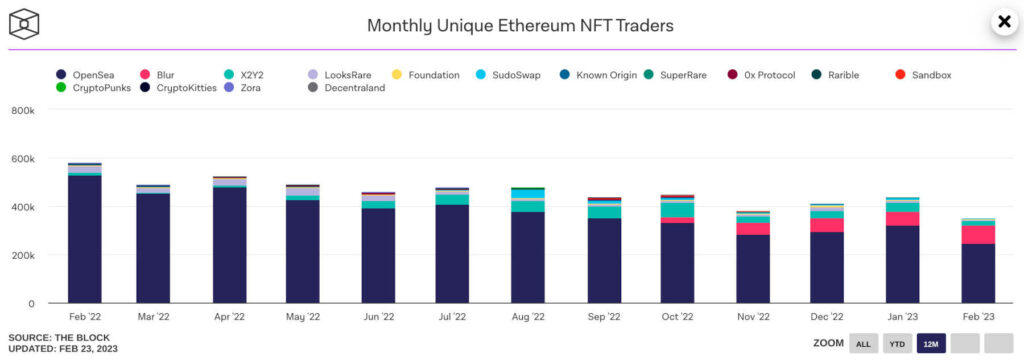

Blur emphasizes its speed. “Execute trades faster and make more money on Blur,” says Blur’s homepage. Since its launch in October of 2022, Blur has been growing rapidly. By December, Blur accounted for over half the total NFT trading volume. By February of 2023, Blur had three times more NFT trading volume than OpenSea. This high volume was primarily due to whales trading ($777m vs OpenSea’s $218m) since OpenSea still had more traders (245k unique traders on OpenSea vs 75,000 on Blur). However, since the $BLUR airdrop on February 14, 2023, daily users on Blur are almost equal to OpenSea.

Blur’s advantages are that (1) they are an aggregator, and one can see the lowest price for an NFT collection across a number of NFT marketplaces. (2) Blur allows a user to transfer ETH off-chain and execute off-chain bids, buys, and sells (which OpenSea also has). (3) Execution of bids is very fast, and the UI is very responsive. (4) Users love the Blur User Interface–the user can sort the real-time price feeds by price and price updates occur every 4 seconds. (5) Blur offers NFT scam protection. (6) Blur does not charge a fee for trades executed on the platform–one only pays gas fees for withdrawing the NFT from the platform. (7) Creators can earn loyalty points (and future $BLUR airdrops) by listing only on Blur.

Blur NFT Disadvantages

Before February 17, 2023, creators couldn’t earn royalties on Blur and OpenSea at the same time. Rather, they could only earn full royalties on OpenSea, or Blur, but not both together. OpenSea’s royalty policy prevented collections from being able to earn royalties everywhere.

On February 14, Blur announced an aggressive policy change, namely, Blur will enforce full creator royalties for any collection that blocks trading on the dominant NFT trading platform OpenSea. Prior to February 14, Blur did not honor full royalty fees; rather, the platform only enforced a 0.5% minimum creator royalty, with the option for traders to pay more.

Blur recommends to NFT creators that they should block OpenSea. In this way, creators can earn royalties on all marketplaces (except for OpenSea). Blur will enforce full royalties on collections that block trading on OpenSea. Creators who implement this option will be eligible for “Season 2” loyalty airdrops of their $BLUR token.

Creators can choose to block Blur, in which case OpenSea will enforce royalties and Blur will enforce a minimum of 0.5% royalties. However, Blur believes that blocking Blur does not improve a creator’s ability to earn royalties.

The Battle: OpenSea vs Blur

When marketplaces attempt to impose royalties on collections, traders tend to move to marketplaces with zero royalty policies. This has already happened in the past when Sudo was launched in July 2022, and since then, new marketplaces with a zero royalty approach have emerged.

OpenSea has been trying to enforce royalties without a lot of success, and Blur has also been trying to be an aggregator for NFT sales across all of the NFT marketplaces on Ethereum. Blur has a 0.5% minimum royalty fee that it collects. At the urging of OpenSea, NFT creators started blacklisting Blur because they were not enforcing the full royalty. In January of 2023, Blur began to provide access to NFTs on Opensea that had blacklisted the Blur marketplace. Blur did this via OpenSea’s Seaport API. The Seaport protocol allows users to make offers for NFTs.

The blacklisting wars came to a head on February 17, 2023. OpenSea had been losing a lot of revenue to Blur and others. So, on February 17, 2023, OpenSea announced it was moving to optional creator fees, with a 0.5% minimum, and it will no longer block creators from listing on marketplaces with the same policies. OpenSea also announced that it was moving to a 0% fee for a limited time.

Currently, Blur is still taking an aggressive stance toward OpenSea. Blur is encouraging NFT creators to block OpenSea, and Blur is rewarding them with loyalty points and with future $BLUR airdrops. Even though OpenSea has eased its position on blacklists, Blur is still giving loyalty points to NFT creators who only sell NFTs on Blur (and not on OpenSea).

The Verdict: OpenSea or Blur

There are many reasons why Blur is going to be a major competitor to OpenSea. Up until now, OpenSea has been the dominant NFT marketplace with few challengers. Blur is now challenging that dominance. The advantages of using Blur over OpenSea are (1) a beautiful, responsive UI with few bugs and with real-time price updates and advanced filters, (2) Blur is an aggregator, and (3) loyalty rewards and $BLUR airdrops.

The OpenSea NFT marketplace sometimes displays errors and outdated information, which can be frustrating for users who rely on real-time updates to make informed decisions about purchasing and selling NFTs. This is particularly problematic during minting when accurate information about the collection is crucial, but may not be readily available due to website errors or outdated data. A functional and reliable NFT marketplace is essential for users to have a positive experience and make informed decisions about buying and selling NFTs. Blur NFT seems to be less buggy, and users seem to love the user interface. So, Blur gets the win for UI design.

Second, one of the biggest advantages of using Blur is the zero-fee trades. While OpenSea has implemented 0% fees, it is only “for a limited time.” Since bids and trades are done off-chain, the only time to pay gas fees is when one withdraws. Blur gets the win for zero-fee trades.

Blur is a new marketplace that brings together various non-fungible tokens (NFTs) from popular marketplaces like OpenSea, X2Y2 and LooksRare. The platform allows users to purchase and sell NFTs, as well as offering additional services like analyzing, managing portfolios, and comparing prices across multiple marketplaces. This feature allows users to purchase NFTs from various sources all in one place. So, Blur gets the win for being a top-notch NFT aggregator.

Finally, Blur has a robust loyalty program. Blur has already airdropped 360 million $BLUR tokens, and they promise to do much more in Season 2. Blur gets the win for its loyalty program.

The verdict is that Blur is the up-and-coming NFT marketplace that is challenging OpenSea for the top spot. In terms of trading volume, Blur is currently winning. And, Blur seems to be gaining on OpenSea in terms of the number of users.

Final Thoughts

Blur is emerging as a major competitor to OpenSea, which has been the dominant NFT marketplace for some time. OpenSea can be unreliable, displaying errors and outdated information that can be frustrating for users. While they have implemented 0% fees for a limited time, this is not permanent. Many prefer Blur’s UI over OpenSea’s UI. And, Blur’s innovative approach to loyalty rewards sets it apart. It remains to be seen whether Blur will overtake OpenSea in terms of users and trading volume in the long term, but it is certainly a promising up-and-comer in the world of NFT marketplaces. The future of digital asset marketplaces is likely to be shaped by the emergence of new, innovative platforms like Blur.

“The Bitfolio Academy 500” is an NFT for the first 500 members of the Bitfolio Academy Coaching Community. Join the free membership at Bitfolio Academy, and I will send you a notification when the Bitfolio Academy 500 NFT is dropped.

FAQ

Which marketplace is better for buying and selling NFTs?

Many users prefer the user interface and the features of Blur over OpenSea. Blur is an aggregator, so traders have a marketplace, an aggregator, and advanced trading tools all in one platform. Blur advertises 10x faster sweeping, and the ability to snipe rare NFTs faster. Blur has a trending tab feature–users can see what hot projects are being bought in real-time. Moreover, zero trading fees make Blur very attractive. My verdict is that Blur is better for buying and selling NFTs.

Which marketplace is better for discovering new NFTs?

Since Blur is an aggregator, you can find NFTs that are listed on OpenSea and other NFT marketplaces, like LooksRare and Rarible. Blur has a trending tab feature–users can see what hot projects are being bought in real-time. Blur is better for discovering new NFTs.